Financial Plan for Nonprofit organizations play an essential role in addressing societal needs, supporting communities, and advocating for various causes. However, their reliance on donations, grants, and other often unstable sources of income makes financial planning a critical task. The Jones Financial Plan offers a comprehensive framework for nonprofit organizations to achieve financial sustainability, manage resources efficiently, and ensure alignment with their missions.

Key Components of the Jones Financial Plan

The Jones Financial Plan emphasizes a multifaceted approach to financial management, focusing on revenue diversification, expense management, and strategic planning. Below are the core components:

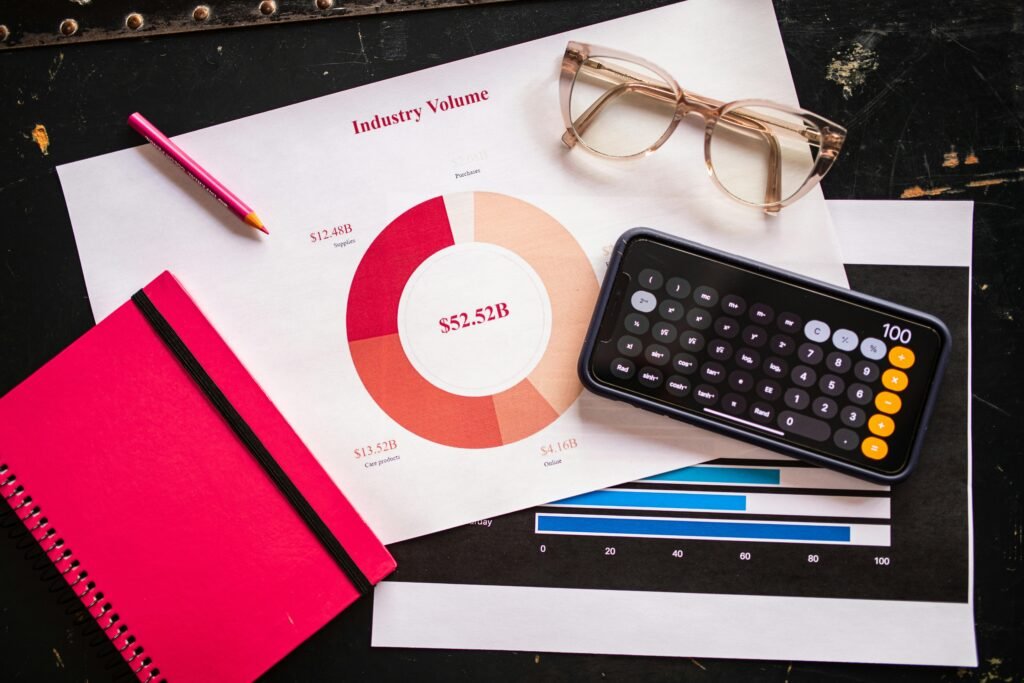

1. Revenue Diversification

A primary challenge for nonprofits is over-reliance on a single funding source. The Jones Financial Plan addresses this by encouraging:

- Fundraising campaigns: developing innovative campaigns that appeal to diverse donor bases.

- Grants: Applying for government, corporate, and foundation grants tailored to the organization’s mission.

- Fee-for-Service Programs: Implementing programs that charge minimal fees while remaining mission-aligned.

- Corporate Partnerships: Establishing collaborations with businesses for sponsorships and joint initiatives.

- Investment Income: Exploring endowments and other investments to generate passive income.

2. Expense Management

Efficient use of funds ensures that resources are maximized for impact. The Jones Financial Plan outlines strategies such as:

- Budgeting: Developing a detailed budget that distinguishes between fixed and variable costs.

- Cost-Reduction Measures: Identifying areas to reduce operational costs without compromising service quality.

- Program Evaluation: Regularly assessing program effectiveness to allocate funds to high-impact initiatives.

- Contingency Planning: Setting aside reserves for unexpected expenses or economic downturns.

3. Strategic Financial Planning

A forward-looking approach is crucial for nonprofit longevity. The Jones Financial Plan recommends:

- Mission Alignment: Ensuring all financial strategies support the organization’s goals and values.

- Long-Term Financial Goals: Establishing clear, measurable objectives for sustainability and growth.

- Risk Assessment: Identifying potential financial risks and implementing mitigation strategies.

- Stakeholder Engagement: Involving donors, beneficiaries, and staff in financial decision-making processes.

Implementation Steps

The success of the Jones Financial Plan lies in its practical application. Nonprofits can implement the plan through the following steps:

Step 1: Conduct a Financial Audit

An audit provides a clear picture of the organization’s current financial health. This includes:

- Reviewing income sources and trends.

- Analyzing expenses to identify inefficiencies.

- Assessing the adequacy of reserves and emergency funds.

Step 2: Develop a Comprehensive Budget

A budget serves as the foundation for financial planning. Key considerations include:

- Estimating revenues from diversified sources.

- Prioritizing expenses that align with the mission.

- Including provisions for unexpected costs.

Step 3: Build a Reserve Fund

Establishing a reserve fund helps ensure stability during financial challenges. The Jones Financial Plan suggests:

- Setting a reserve goal of 3-6 months’ operating expenses.

- Gradually allocating surplus funds to reserves.

- Regularly reviewing and adjusting the reserve fund based on organizational needs.

Step 4: Strengthen Fundraising Efforts

Enhancing fundraising capabilities is essential for sustained income. Nonprofits should:

- Invest in donor management software to track contributions and build relationships.

- Develop storytelling campaigns that showcase their impact.

- Host events, both virtual and in-person, to engage the community and attract new donors.

Step 5: Monitor and Evaluate Progress

Regular monitoring ensures the plan remains effective and relevant. This involves:

- Setting key performance indicators (KPIs) for financial metrics.

- Conducting quarterly reviews of financial statements.

- Soliciting feedback from stakeholders to refine strategies.

Benefits of the Jones Financial Plan

Nonprofits that adopt the Jones Financial Plan can expect numerous advantages, including:

- Financial Stability: Diversified income streams reduce vulnerability to funding fluctuations.

- Operational Efficiency: Streamlined expenses allow more funds to be directed toward impactful programs.

- Enhanced donor trust: transparent financial practices build credibility and encourage continued support.

- Mission Success: A strategic approach ensures resources are aligned with organizational goals, maximizing impact.

Case Studies: Success Stories

Several nonprofits have successfully implemented the Jones Financial Plan, demonstrating its effectiveness:

- Community Health Alliance: This organization diversified its revenue by adding fee-for-service programs, which accounted for 25% of its income within two years. The additional funds allowed them to expand services and reach more beneficiaries.

- Green Earth Initiative: By adopting cost-reduction measures and renegotiating vendor contracts, this environmental nonprofit saved $50,000 annually, which was reinvested into conservation projects.

- Youth Empowerment Network: A focus on strategic fundraising campaigns led to a 40% increase in donor contributions over three years, enabling the nonprofit to launch new educational programs.

Challenges and Solutions

While the Jones Financial Plan provides a robust framework, nonprofits may encounter challenges during implementation. Common issues and recommended solutions include:

- Resistance to Change: Engage staff and stakeholders through workshops and clear communication about the plan’s benefits.

- Limited Resources: Start with small, incremental changes and leverage volunteer support to offset costs.

- Economic uncertainty: Build flexibility into financial strategies to adapt to changing economic conditions.

Conclusion

The Jones Financial Plan equips nonprofit organizations with the tools and strategies necessary to navigate the complex financial landscape. By focusing on revenue diversification, expense management, and strategic planning, nonprofits can achieve financial sustainability and continue their vital work in serving communities. Adopting this comprehensive approach ensures that resources are not only preserved but also optimized for maximum impact.