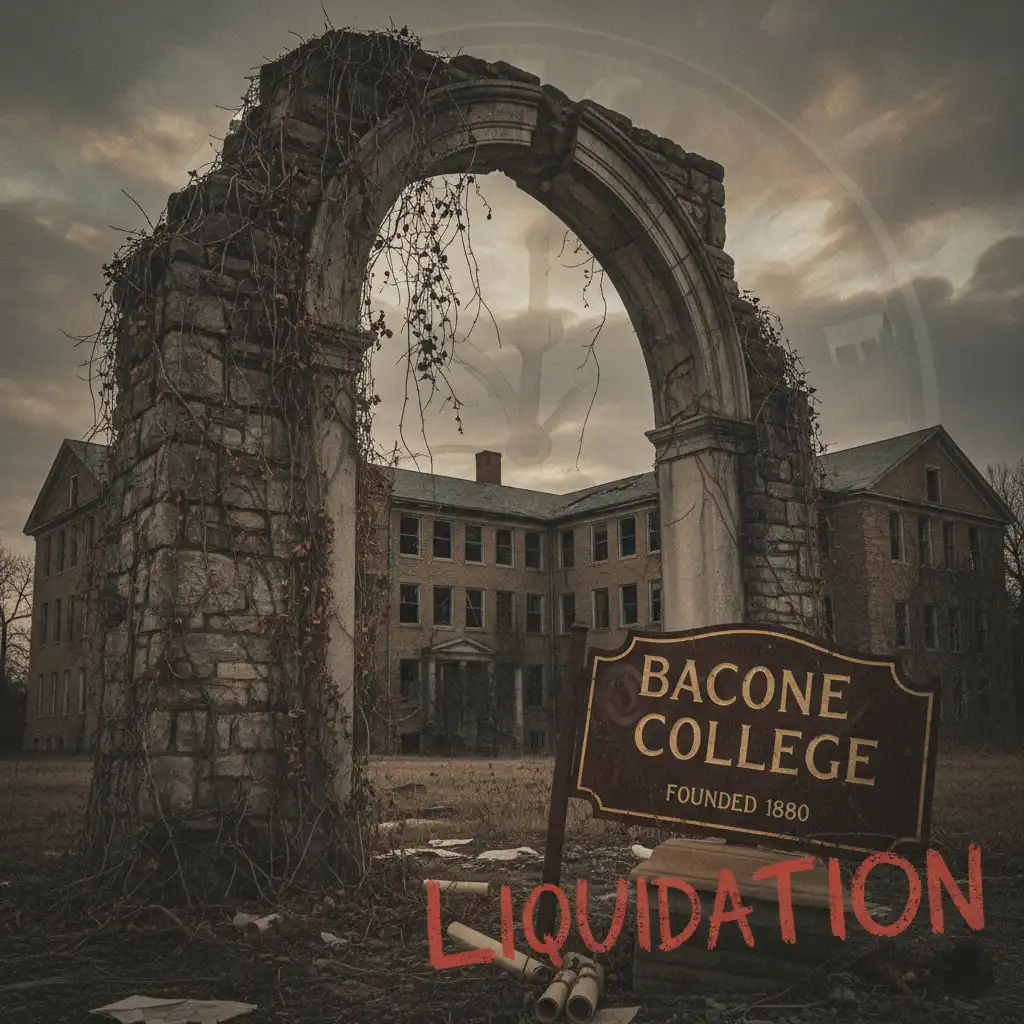

The Bacone College financial collapse marks the end of a 145-year-old institution that served as a beacon for Native American education in Oklahoma. Once a thriving school founded to uplift Indigenous communities, Bacone ran out of funds, lost its accreditation, and faced court-ordered liquidation in 2025. This article provides a straightforward timeline of events, root causes, stakeholder impacts, and lessons for the future. Drawing from court records and reliable reporting, it highlights why this closure reverberates through Native higher education and local communities, offering insights to prevent similar fates.

Brief History & Legacy Before the Bacone College Financial Collapse

Bacone College’s story is one of resilience and cultural significance, making its financial downfall all the more poignant. Established as a mission-driven school, it evolved into a vital hub for Native arts and education, only to succumb to modern economic pressures.

Founding and Mission: From Indian University to Bacone College (1880)

Bacone College traces its roots to 1880, when it opened as the Indian University in Muskogee, Oklahoma Territory. Founded by missionaries with a focus on educating Native American students, it later adopted the name Bacone College in honor of a Baptist leader. Over 145 years, it grew into a private liberal arts institution, emphasizing Indigenous perspectives and serving students from over 20 tribes. This legacy of empowerment turned its collapse into a profound cultural milestone.

Role in Native American Education and the Art Program

Bacone stood out for its commitment to Native higher education, offering programs tailored to tribal needs and fostering leadership among Indigenous students. Its renowned art department produced influential works blending traditional and contemporary Native styles, amassing a collection of paintings, sculptures, and artifacts that drew national acclaim. As finances faltered, safeguarding this collection became a rallying cry, underscoring Bacone’s irreplaceable role in preserving Native heritage.

Campus and Historic Designation

Nestled on 200 acres in Muskogee, Bacone’s campus features Gothic Revival buildings from the early 1900s, earning a spot on the National Register of Historic Places in 1976. Structures like Ataloa Lodge, with its Native-inspired murals, symbolize the school’s enduring spirit. This historic status complicated the financial collapse, as liquidation threats raised alarms about demolishing or selling irreplaceable sites tied to Oklahoma’s Indigenous history.

Timeline: Key Events Leading to the Bacone College Financial Collapse

The path to closure spanned years of mounting crises, from early cash shortages to courtroom battles. This chronology captures the escalating urgency.

Early Warning Signs (2018)

Trouble surfaced in 2018 when Bacone abruptly suspended classes mid-semester, citing exhausted funds and unpaid staff. Enrollment had dipped below 100 students, straining an already tight budget. This halt forced faculty layoffs and student transfers, signaling deeper operational woes that administrators downplayed at the time.

2019–2023: Lawsuits, Sheriff’s Sale Notices, and Campus Deterioration

The following years brought a barrage of legal challenges. Unpaid vendors filed lawsuits, culminating in judgments exceeding $2 million. Muskogee County issued sheriff’s sale notices in 2020 and 2022 to auction campus land, only to postpone them after last-minute interventions. Meanwhile, deferred maintenance led to crumbling roofs, mold infestations, and utility shutoffs, turning the once-vibrant campus into a symbol of neglect.

2024: Accreditation Withdrawal and Chapter 11 Filing

Mid-2024 delivered crushing blows. On July 17, the Higher Learning Commission revoked Bacone’s accreditation due to persistent financial instability and governance lapses, severing access to federal student aid. Days earlier, the college filed for Chapter 11 bankruptcy, aiming to restructure debts while keeping doors open. These twin hits made recruitment impossible and accelerated the downward spiral.

2025: “Gross Mismanagement” Motion, Chapter 7 Conversion, and Liquidation Orders

The turning point came in May 2025, when a U.S. bankruptcy trustee accused Bacone’s leadership of “gross mismanagement,” including unauthorized fund transfers and failure to file reports. A federal judge agreed, converting the case to Chapter 7 liquidation. This shift prioritized asset sales over revival, effectively shuttering the college and ordering the sale of its historic campus.

2025–Present: Auctions of Campus Assets and Final Disposition

Since the conversion, trustees have auctioned off furniture, vehicles, lab equipment, and non-essential items, raising over $500,000 by September 2025. Student records and cultural artifacts were exempted and transferred to secure storage. Ongoing bids for the main campus parcel, valued at $3.5 million against $10 million in debts, continue, with preservation groups vying to block commercial development.

Root Causes Behind the Bacone College Financial Collapse

Bacone’s demise stemmed from intertwined financial, operational, and structural vulnerabilities common to small private colleges.

Chronic Enrollment Decline and Tuition Dependence

With tuition covering 80% of its budget, Bacone relied heavily on student fees. Enrollment plummeted from 900 in the 1990s to under 50 by 2023, due to competition from larger state schools and online programs. This revenue cliff left no buffer for economic downturns or marketing shortfalls.

Debt Accumulation and Unpaid Vendor Judgments

Debts snowballed from $5 million in 2015 to over $12 million by 2024, fueled by loans for expansions and unpaid bills. A $1.2 million judgment against a heating contractor in 2021 alone triggered aggressive collections, including wage garnishments and property liens that choked cash flow.

Loss of Accreditation and Impact on Federal Aid

Accreditation loss in 2024 was catastrophic, as it barred Pell Grants and loans—vital for 90% of Bacone’s students. Without this lifeline, prospective enrollees vanished, dooming reorganization efforts and highlighting the fragility of aid-dependent models.

Governance Failures and Alleged Mismanagement

Court documents revealed lax oversight, with board infighting and questionable executive spending, including $300,000 in unapproved consultant fees. The trustee’s 2025 motion cited these as deliberate sabotage, eroding donor trust and inviting federal scrutiny.

Missed Opportunities for Federal or Tribal Support

Unlike federally chartered tribal colleges, Bacone’s private status denied it consistent Title III funding or tribal endowments. Failed bids for tribal consortium status in 2022 left it isolated, unable to tap the $100 million+ in annual Native education grants.

Deferred Maintenance and Preservation Costs

Historic upkeep demanded $2 million annually, but budgets allocated just 5%. Unaddressed issues like asbestos abatement and HVAC failures not only deterred students but also invited lawsuits, compounding the debt cycle.

Stakeholders & Perspectives on the Bacone College Financial Collapse

The closure touched diverse groups, each grappling with loss and uncertainty.

Students and Alumni: Grief, Questions, and Calls for Preservation

Current and former students mourned a “second home,” with many scrambling for transcripts to complete degrees elsewhere. Alumni launched petitions for artifact repatriation, fearing cultural erasure, and shared stories of Bacone’s transformative role in their lives.

Tribal Nations and Founders: Cultural and Legal Stakes

Leaders from the Muscogee (Creek) Nation and Seminole tribes, whose members founded Bacone, decried the loss as a “heritage theft.” Legal challenges invoke treaty rights to block land sales, arguing the campus embodies sovereign educational promises from the 1800s.

Creditors and Contractors: Enforcing Debts

Vendors, from textbook suppliers to construction firms, viewed liquidation as overdue justice after years of bounced checks. While sympathetic to the cultural toll, they prioritized recovering $8 million in unsecured claims through asset proceeds.

Trustees, Administrators, and Bankruptcy Officials

Former administrators defended their tenure, blaming external factors like the pandemic. The bankruptcy trustee, however, painted a picture of avoidable chaos, justifying the shift to Chapter 7 to protect creditors from further losses.

Preservationists and Local Officials

Muskogee historians and the Oklahoma Historical Society advocated for adaptive reuse, proposing a cultural center over demolition. City officials balanced economic fallout—200 lost jobs—with incentives for buyers committed to heritage preservation.

Legal & Financial Mechanics: Understanding the Bankruptcy and Liquidation Process

Navigating Bacone’s bankruptcy reveals the cold mechanics of institutional death.

Chapter 11 vs. Chapter 7: What They Mean for a College

Chapter 11 offers a “breathing spell” for reorganization, allowing operations to continue while negotiating debt plans. Chapter 7, triggered by feasibility doubts, mandates asset liquidation, halting all activities. Bacone’s 2025 conversion sealed its fate, prioritizing payouts over pedagogy.

Who Files Claims and Who Gets Paid First

Creditors submit proofs of claim within 90 days; secured ones (e.g., bank liens) recover first, followed by administrative expenses like trustee fees. Unsecured vendors, Bacone’s largest group, often receive pennies on the dollar—estimated at 20% here.

What Happens to Student Records, Scholarships, and Cultural Artifacts

Federal law mandates transcript transfers to a state agency, ensuring access for degrees. Scholarships revert to donors or funds, while artifacts face ownership disputes—some donated, others purchased—prompting tribal claims under NAGPRA protections.

Sale of Assets: Campus Land Valuation and Auction Mechanics

Trustees appraise via independent firms ($3.5 million for 200 acres), then solicit bids through public notices. Online auctions for movables fetched quick sales, but land requires court approval, with bids scrutinized for community impact.

Comparative Analysis: Small & Tribal Colleges That Faced Similar Financial Collapse

Bacone’s story echoes others, offering cautionary parallels.

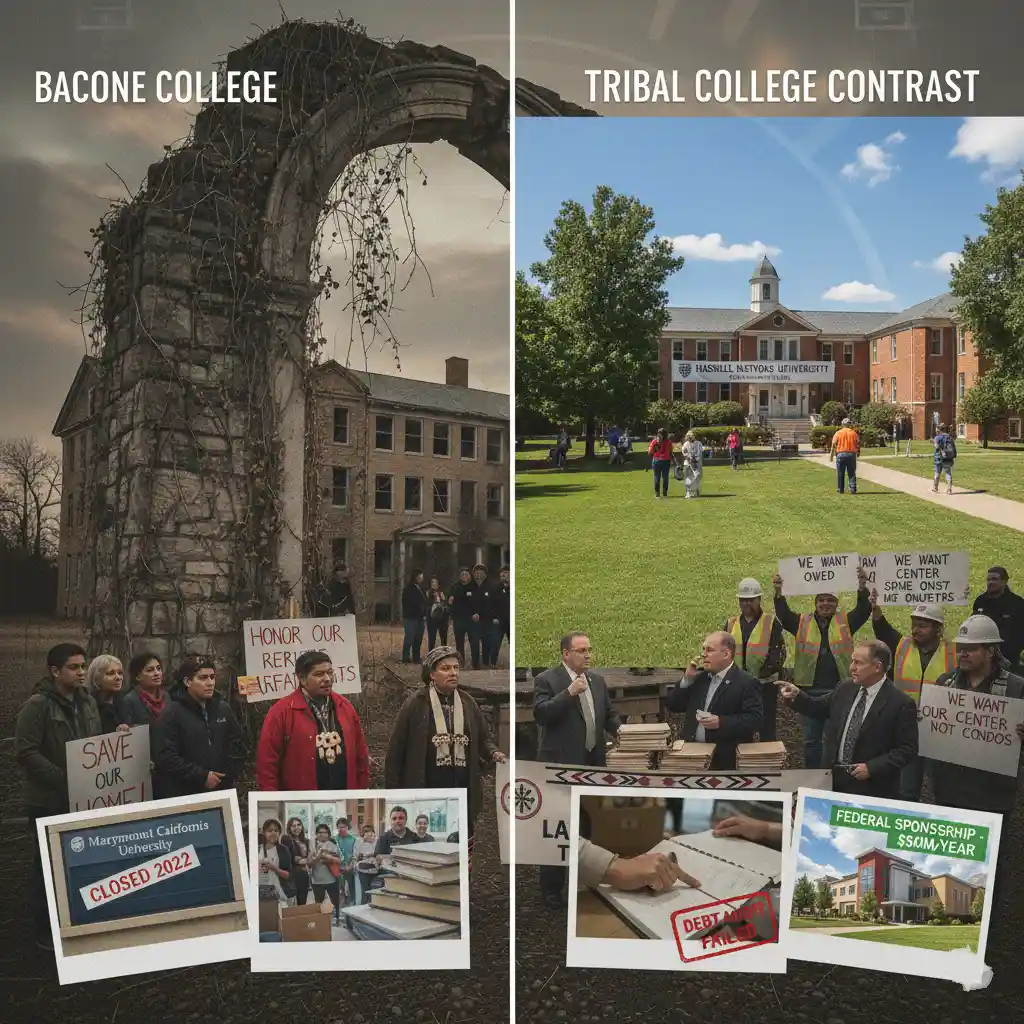

Common Patterns in Small College Failures

Like Marymount California (2022) or Northern New Mexico College’s near-miss, Bacone shared enrollment drops, aid reliance, and delayed interventions. These “zombie colleges” often linger in denial until accreditation snaps the lifeline.

Tribal College Contrast: Why Federal Sponsorship Matters

Tribal colleges like Haskell Indian Nations University thrive on $50 million annual federal allocations, buffering against fluctuations. Bacone’s outsider status exposed it to market whims, unlike peers with sovereign backing.

Lessons Other Institutions Learned

Survivors like Concordia College rebounded via mergers or endowments. Early metrics—enrollment dashboards, debt audits—enable pivots, as seen in Crown College’s 2023 turnaround through tribal partnerships.

Consequences and Long-Term Implications of the Bacone College Financial Collapse

The ripple effects extend far beyond Muskogee’s borders.

For Native Higher Education and Cultural Preservation

Bacone’s closure shrinks options for 1,500+ Native students in Oklahoma, straining tribal programs. Its art trove, valued at $5 million, risks dispersal, potentially fragmenting a key archive of 20th-century Indigenous expression.

For Muskogee and Local Economy

The college supported 150 jobs and $10 million in annual spending; its void hits retailers and tourism. Historic tourism, once drawing 5,000 visitors yearly, now hangs in limbo amid sale uncertainties.

Policy Implications and Accreditation Oversight

This case spotlights accreditation’s role as a financial gatekeeper, prompting calls for phased withdrawals and state bailouts. Federal reviews may tighten monitoring for at-risk privates.

Lessons for Boards, Donors, and Tribal Partners

Transparent audits and diversified funding—e.g., tribal endowments—emerge as essentials. Donors should prioritize governance metrics, while tribes explore consortium models for shared resilience.

What Could Have Been Done: Proposed Rescue Strategies & Realistic Alternatives

Hindsight reveals viable paths forward.

Short-Term Emergency Measures

Emergency loans from foundations like the Mellon Trust could have bridged 2018 gaps, buying time for enrollment drives. Crowdfunding campaigns, as in SaveOurSchools efforts, raised $1 million for peers.

Mid-Term Structural Changes

Affiliating with Oklahoma State University, as some proposed in 2022, might have offloaded operations while retaining Native focus. Program cuts—non-core majors—could trim 30% of costs without gutting mission.

Long-Term Sustainability

Revenue streams like online certificates and tribal apprenticeships diversify income. Robust boards with financial experts, per best practices, prevent the insularity that doomed Bacone.

Resources, Documents & Primary Sources (Appendix)

For deeper dives:

- Associated Press: Coverage of debts and disrepair.

- Higher Learning Commission: Accreditation withdrawal letter (July 17, 2024).

- Inside Higher Ed: Bankruptcy filing and liquidation reports.

- Higher Ed Dive: Trustee’s mismanagement motion.

- KTUL: Local auction updates and record protections.

FAQs

What happened to Bacone College?

Bacone filed for Chapter 11 bankruptcy in 2024, lost accreditation, and in May 2025, a judge converted it to Chapter 7, ordering asset liquidation to pay creditors.

Is Bacone College permanently closed?

Yes; the Chapter 7 conversion ended operations, with trustees now selling assets to settle debts.

Why did Bacone fail financially?

Declining enrollment, mounting vendor debts, accreditation loss, governance issues, and lack of federal/tribal funding were key factors.

What will happen to student records and artworks?

Student records are protected and transferable; artworks face preservation challenges, with tribal groups advocating for repatriation amid mold concerns.

Conclusion

The Bacone College financial collapse serves as a stark reminder of the vulnerabilities facing mission-driven institutions in an era of shrinking enrollments and rising costs. For Native communities, it’s a cultural gut punch; for small colleges everywhere, a call to adapt or perish. Transparent governance, diversified funding, and proactive partnerships could have altered this trajectory—lessons worth heeding now.

If Bacone’s story moves you, share this article to amplify Native voices, comment with your memories below, or sign up for updates on preservation efforts and auction outcomes. Together, we can advocate for the heritage it leaves behind.